Price Action Profits

$14.00

- Affordable & Permanent Stored Courses

- No hidden charges

- We care about your privacy

- Instant MEGA links Download

- 100% Safe and Secure Payments

- Description

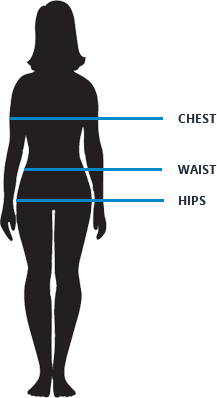

- Size Guide

- Reviews (0)

Description

Price Action Profits

Price Action Profits . describes the characteristics of a security’s price movements. This movement is quite often analyzed with respect to price changes in the recent past. In simple terms, price action is a trading technique that allows a trader to read the market and make subjective trading decisions based on the recent and actual price movements, rather than relying solely on technical indicators.

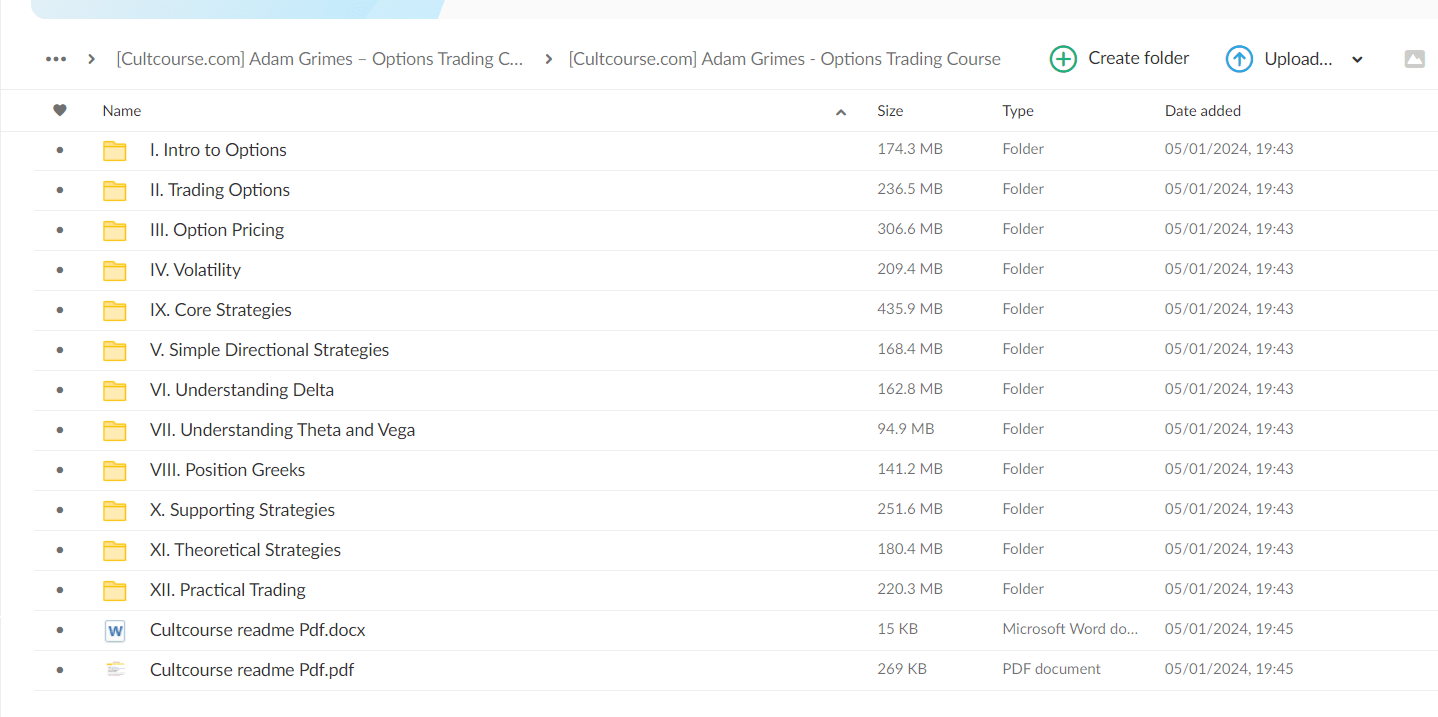

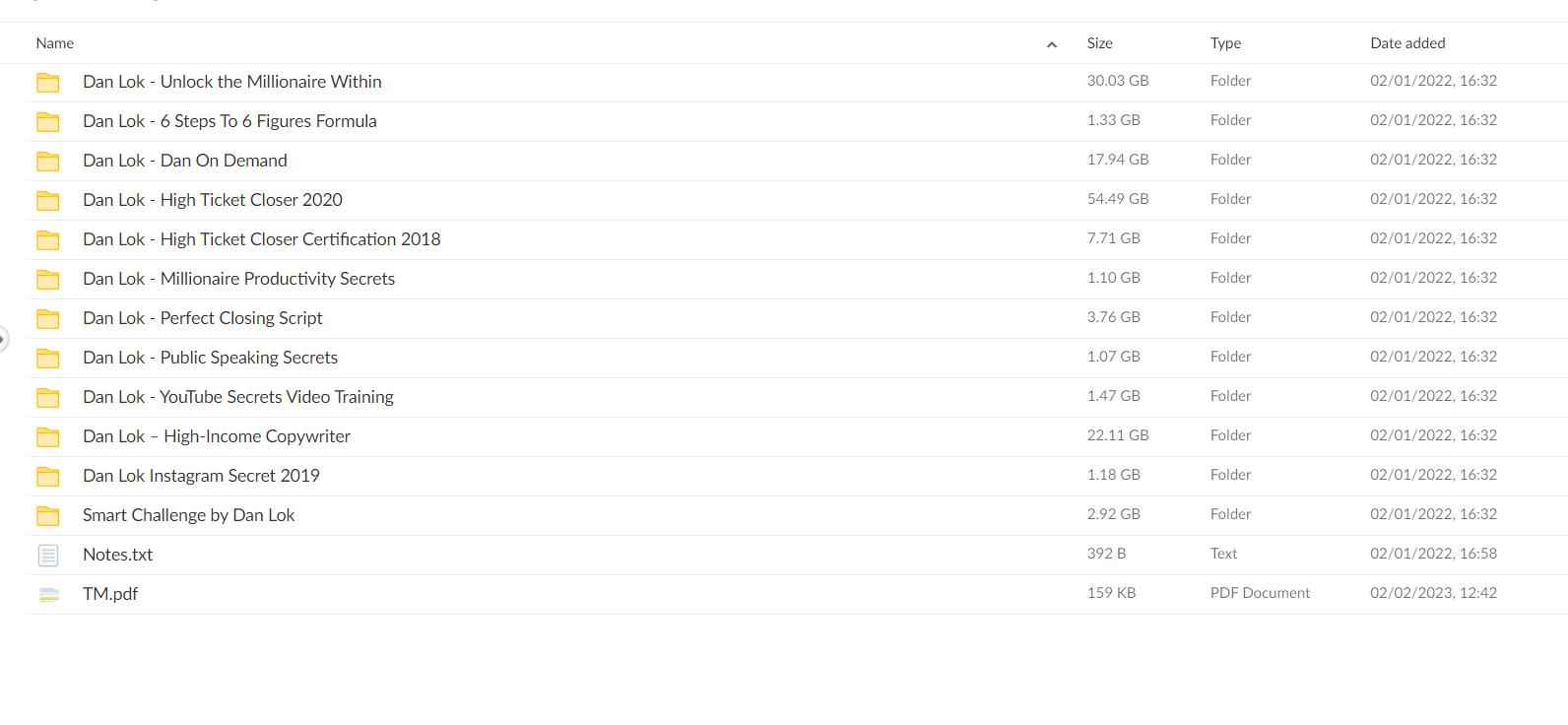

File Size – 349.8 MB .

Since it ignores the fundamental analysis factors and focuses more on recent and past price movement, the price action trading strategy is dependent on technical analysis tools.

- Many day traders focus on price action trading strategies to quickly generate a profit over a short time frame.

- For example, they may look for a simple breakout from the session’s high, enter into a long position, and use strict money management strategies to generate a profit.

- Several tools and software platforms can be used to trade price action.

Tools Used for Price Action Trading

Since price action trading relates to recent historical data and past price movements, all technical analysis tools like charts, trend lines, price bands, high and low swings, technical levels (of support, resistance and consolidation), etc. are taken into account as per the trader’s choice and strategy fit.

The tools and patterns observed by the trader can be simple price bars, price bands, break-outs, trend-lines, or complex combinations involving candlesticks, volatility, channels, etc.

Psychological and behavioral interpretations and subsequent actions, as decided by the trader, also make up an important aspect of price action trades. For e.g., no matter what happens, if a stock hovering at 580 crosses the personally-set psychological level of 600, then the trader may assume a further upward move to take a long position. Other traders may have an opposite view – once 600 is hit, they assume a price reversal and hence takes a short position.

No two traders will interpret a certain price action in the same way, as each will have their own interpretation, defined rules and different behavioral understanding of it. On the other hand, a technical analysis scenario (like 15 DMA crossing over 50 DMA) will yield similar behavior and action (long position) from multiple traders.

-

- Please leave your email address for further Updates from Cultcourse

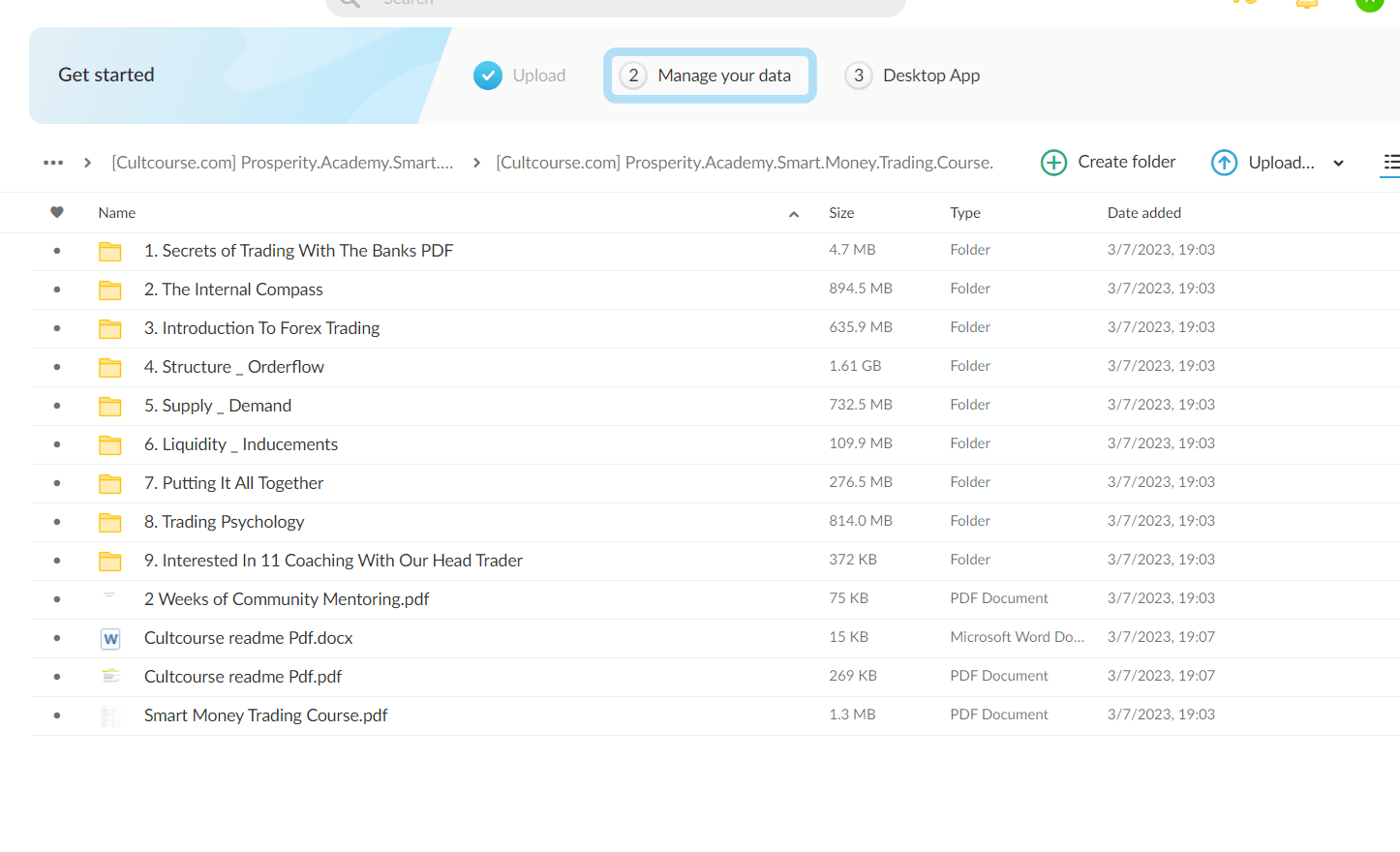

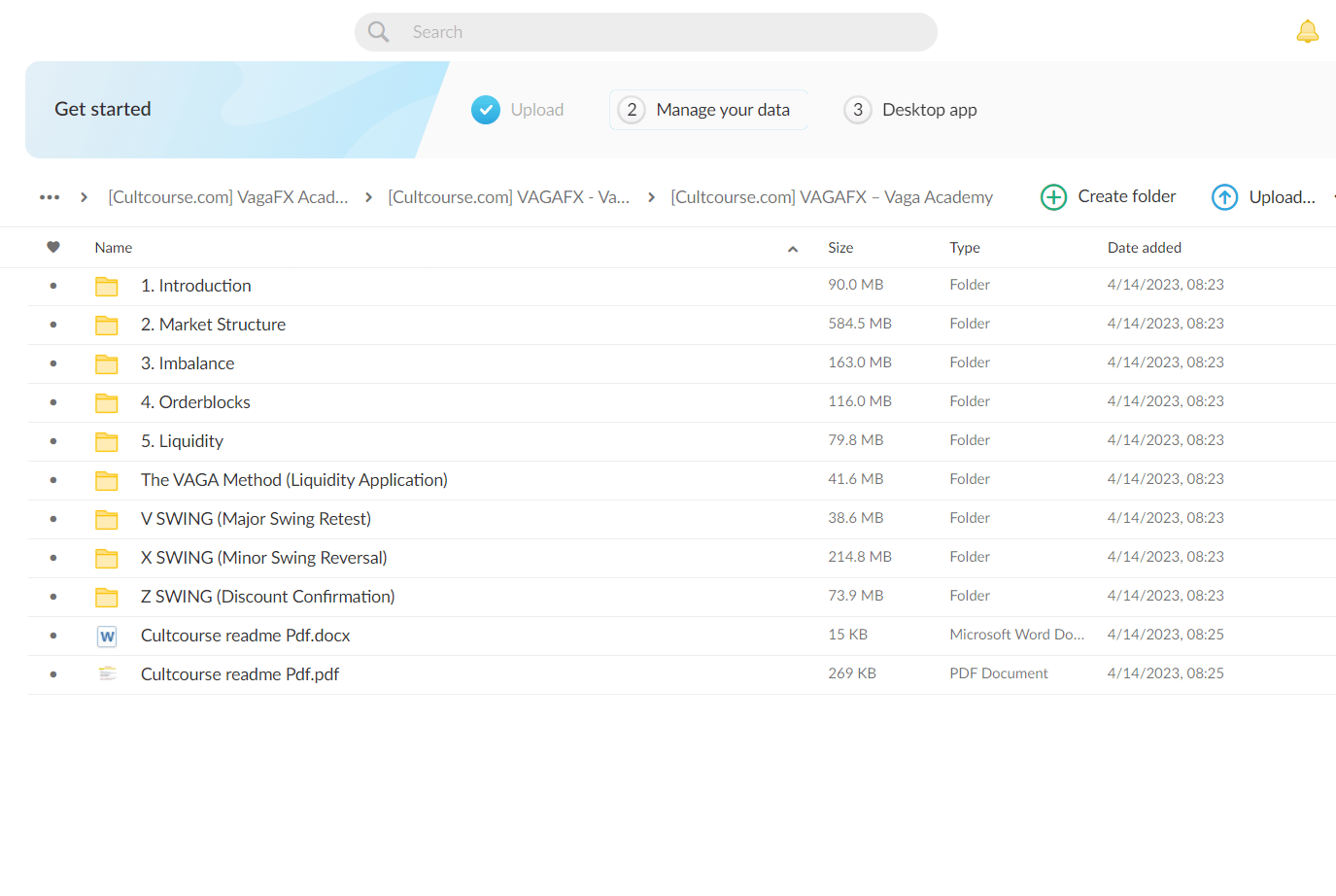

- Files will be delivered through MEGA Download Link

- Permanent Stored Courses

- 100% Safe & Secure Payments

join us on Telegram : http://t.me/cultcourseJoin us on Instagram : https://www.instagram.com/cultcourse/more courses like this : http://cultcourse.com/shop/

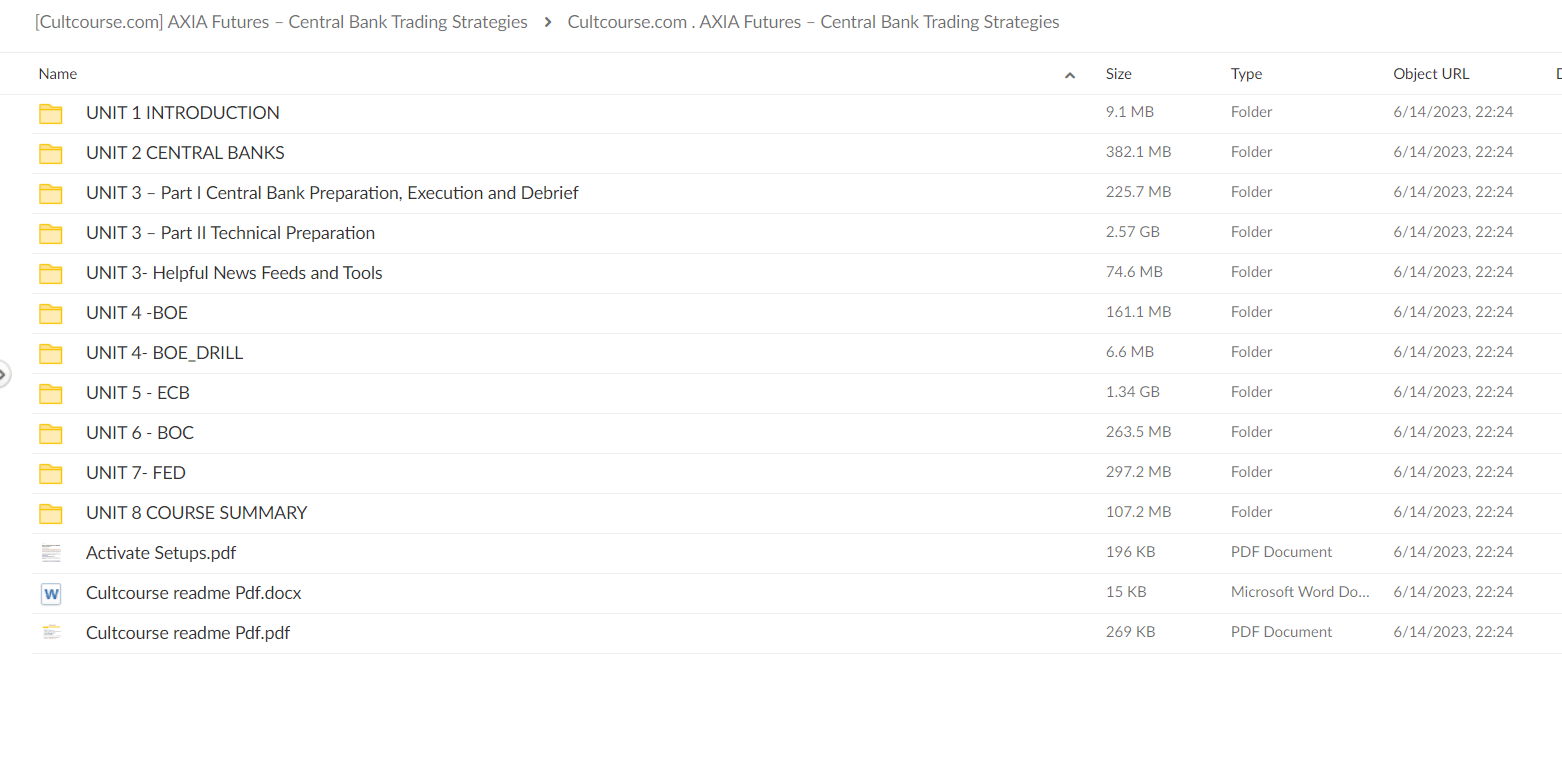

File Size – 348.4 MB

| size | chest(in.) | waist(in.) | hips(in.) |

|---|---|---|---|

| XS | 34-36 | 27-29 | 34.5-36.5 |

| S | 36-38 | 29-31 | 36.5-38.5 |

| M | 38-40 | 31-33 | 38.5-40.5 |

| L | 40-42 | 33-36 | 40.5-43.5 |

| XL | 42-45 | 36-40 | 43.5-47.5 |

| XXL | 45-48 | 40-44 | 47.5-51.5 |

Reviews

There are no reviews yet.