Hot

-76%

James – The Python for Traders Masterclass

Original price was: $49.00.$12.00Current price is: $12.00.

- Affordable & Permanent Stored Courses

- No hidden charges

- We care about your privacy

- Instant MEGA links Download

- 100% Safe and Secure Payments

- We Also Accepts Payment Through UPI

- Description

- Size Guide

- Reviews (0)

Description

James – The Python for Traders Masterclass

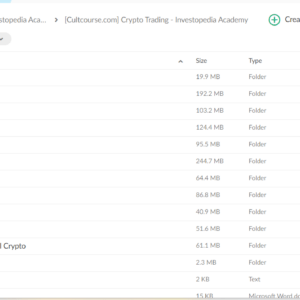

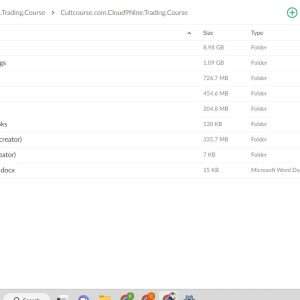

James – The Python for Traders Masterclass . File Size – 491.8

What You Get :

The Python for Traders Masterclass

8 Modules

4 Projects

105 Lessons

248 Code Examples

34 Hours of Content

Module 1: Introduction

- 1.1. Welcome to the Python for Traders Masterclass(2:14)PREVIEW

- 1.2. Why learn to code as a trader?(7:15)PREVIEW

- 1.3. Why should traders learn Python?(4:23)PREVIEW

- 1.4. What will I gain from this course ? PREVIEW

- 1.5. What topics will be covered ? PREVIEW

- 1.6. Who is the intended audience for this course ? PREVIEW

- 1.7. How much finance knowledge do I need?(1:40)PREVIEW

- 1.8. How much coding knowledge do I need?(1:37)PREVIEW

- 1.9. Placement Quiz: Am I a good fit for this course ? PREVIEW

- 1.10. Module Quiz START

Module 2: Python Fundamentals for Finance

- 2.1. Python Installation and Setup START

- 2.2. Running Python Code START

- 2.3. Basic Python(26:34)START

- 2.4. Intermediate Python(5:07)START

- 2.5. Advanced Python START

- 2.6. Data Science in Python START

- 2.7. Key library: Pandas START

- 2.8. Key library: NumPy START

- 2.9. Key library: Matplotlib START

- 2.10. Key library: Stats models START

- 2.11. Key library: Scikit-learn START

Module 3: Working with Financial Data

- 3.1. Introduction to Financial Data: Time Series and Cross-Sections START

- 3.2. Data Acquisition and Cleaning(18:09)START

- 3.3. Time Series Analysis(13:38)START

- 3.4. Understanding Stationarity(11:55)START

- 3.5. Time Series Forecasting START

- 3.6. Exploratory Data Analysis START

- 3.7. Section summary START

Module 4: How to Code and Backtest a Trading Algorithm

- 4.1. So what is a trading algorithm ? START

- 4.2. Algorithm Design Principles START

- 4.3. Data Management Module(15:12)START

- 4.4. Signal Generation Module(15:12)START

- 4.5. Risk Management Module(10:58)START

- 4.6. Trade Execution Module(10:27)START

- 4.7. Portfolio Management Module(11:05)START

- 4.8. Backtesting Basics START

- 4.9. Backtesting Software START

- 4.10. Advanced Backtesting Techniques START

- 4.11. Optimization and Parameter Tuning START

Project 1: Research & Backtest a Realistic Trading Algorithm

- Project Overview(6:57)START

- Step 1: Getting Started on Quant Connect(6:53)START

- Step 2: Formulate a Strategy START

- Solution: Formulate a Strategy START

- Step 3: Develop the Algorithm START

- Solution: Develop the Algorithm START

- Step 4: Run a Backtesting Analysis START

- Solution 4: Run a Backtesting Analysis START

- Project Summary START

Module 5: Automated Data Collection, Cleaning, and Storage

- 5.1. Sourcing financial data(5:38)START

- 5.2. Working with CSVs START

- 5.3. Working with JSONSTART

- 5.4. Scraping data from APIs(51:35)START

- 5.5. Scraping data from websites START

- 5.6. Persisting data: files and databases START

- 5.7. Section summary START

Module 6: Analyzing Fundamentals in Python

- 6.1. Structured vs. Unstructured Data START

- 6.2. Types of Fundamental Data START

- 6.3. Gathering & Cleaning Fundamental Data START

- 6.4. Automated Screening & Filtering START

- 6.5. Statistical Analysis of Fundamental Data START

- 6.6. Natural Language Processing on News Articles START

- 6.7. Natural Language Processing on Annual Reports START

- 6.8. Using LLMs for Natural Language Processing START

Module 7: Options & Derivatives Pricing Models

- 7.1. Introduction to Options & Derivatives START

- 7.2. Basics of Option Pricing START

- 7.3. The Binomial Options Pricing Model START

- 7.4. The Black-Scholes-Merton Model START

- 7.5. Monte Carlo Simulation for Option Pricing START

- 7.6. Introduction to Exotic Options START

- 7.7. Interest Rate Derivatives and Term Structure START

- 7.8. Implementing Finite Difference Methods for Option Pricing START

- 7.9. Volatility and Implied Volatility START

- 7.10. Advanced Topics and Modern Developments (Optional)START

Project 2: Volatility Surface Analysis Tool

- Project Overview START

- Step 1: Fetching Options Data START

- Solution: Fetching Options Data START

- Step 2: Calculating Implied Volatilities START

- Solution: Calculating Implied Volatilities START

- Step 3: Plot a 3D Volatility Surface START

- Solution: Plot a 3D Volatility Surface START

- Project Summary START

Module 8: Introduction to High-Frequency Trading

- 8.1. What is High Frequency Trading (HFT)?START

- 8.2. Handling High-Frequency Tick Data START

- 8.3. Latency Measurement and Simulation START

- 8.4. Understanding the HFT Market Making Strategy START

- 8.5. Understanding Statistical Arbitrage with High-Frequency Data START

- 8.6. Signal Processing for HFTSTART

- 8.7. Real-time News Processing START

- 8.8. Section summary START

Project 3: Design & Build a Limit Order Book

- Project Overview START

- Step 1: Design the Data Structure START

- Solution: Design the Data Structure START

- Step 2: Add Functionality START

- Solution: Add Functionality START

- Step 3: Simulate Live Orders START

- Solution: Simulate Live Orders START

- Project Summary START

Capstone Project: Coding a Simple HFT Market Making Bot

- Project Overview START

- Step 1: Define a System and Class Architecture START

- Solution: Define a System and Class Architecture START

- Step 2: Define the Event Loop START

- Solution: Define the Event Loop START

- Step 3: Implement the Data Feeds START

- Solution: Implement the Data Feeds START

- Step 4: Implement the Order Manager START

- Solution: Implement the Order Manager START

- Step 5: Add Alpha to the Pricing Strategy START

- Solution: Add Alpha to the Pricing Strategy START

- Project Summary START

- Please leave your email address for further Updates from Cultcourse

- Files will be delivered through MEGA Download Link

- Permanent Stored Courses

- 100% Safe & Secure Payments

join us on Telegram : http://t.me/cultcourse

Join us on Instagram : https://www.instagram.com/cultcourse/

more courses like this : http://cultcourse.com/shop/

| size | chest(in.) | waist(in.) | hips(in.) |

|---|---|---|---|

| XS | 34-36 | 27-29 | 34.5-36.5 |

| S | 36-38 | 29-31 | 36.5-38.5 |

| M | 38-40 | 31-33 | 38.5-40.5 |

| L | 40-42 | 33-36 | 40.5-43.5 |

| XL | 42-45 | 36-40 | 43.5-47.5 |

| XXL | 45-48 | 40-44 | 47.5-51.5 |

Reviews

There are no reviews yet.